George Soros und sein Firmenimperium

Stoppt die Corona-App – Corona-APP ist schwerer Eingriff in die Privatsphäre

George Soros Firmenliste Regierung Washington

Firmenverzeichnisse werden öffentlich aufgelistet in den USA .

Hier ist eine Liste der Firmen von Herrn George Soros (Gast bei Kanzler Kurz im österreichischen Parlament ) von der Regierung von Washington:

Quelle 2018:

https://www.sec.gov/Archives/edgar/data/1029160/000101143810000476/form_13f-soros.txt

siehe auch: https://www.gurufocus.com/news/317260/george-soros-top-new-holdings

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 13F

FORM 13F COVER PAGE

Report for the Calendar Year or Quarter Ended: September 30, 2010

Check here if Amendment [ ]; Amendment Number:

This Amendment (Check only one.): is a restatement. adds new holdings entries.

Institutional Investment Manager Filing this Report:

Name: Soros Fund Management LLC

Address: 888 Seventh Avenue

New York, New York 10106

Form 13F File Number: 028-06420

The institutional investment manager filing this report and the person by whom it is signed hereby represent that the person signing the report is authorized

to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements,

schedules, lists, and tables, are considered integral parts of this form.

Person Signing this Report on Behalf of Reporting Manager:

Name: Jodye M. Anzalotta

Title: Assistant General Counsel

Phone: 212-320-5531

Signature, Place, and Date of Signing:

/s/ Jodye M. Anzalotta New York, New York November 15, 2010

1. 028-10418 George Soros

Soros Fund Management LLC

Form 13F Information Table

Quarter ended September 30, 2010

VALUE SHRS OR SH/ PUT/ INV. VOTING AUTHORITY

ISSUER TITLE OF CLASS CUSIP (X$1000) PRN AMT PRN CALL DISC. OTHER MGR** SOLE SHARED NONE

A C MOORE ARTS & CRAFTS

INC COM 00086T103 $ 59 26,000 SH SOLE 1 X

A D C TELECOMMUNICATIONS COM NEW 000886309 $ 8,348 658,857 SH SOLE 1 X

A D C TELECOMMUNICATIONS SUB NT CV FLT 13 000886AB7 $ 80,122 80,677,000 PRN SOLE 1 X

AFLAC INC COM 001055102 $ 383 7,400 SH SOLE 1 X

AGCO CORP COM 001084102 $ 421 10,800 SH SOLE 1 X

AGL RES INC COM 001204106 $ 395 10,300 SH SOLE 1 X

AES CORP COM 00130H105 $ 159 14,000 SH SOLE 1 X

AK STL HLDG CORP COM 001547108 $ 1,381 100,000 SH SOLE 1 X

AT&T INC COM 00206R102 $ 51,365 1,795,982 SH SOLE 1 X

AARONS INC COM 002535201 $ 339 18,400 SH SOLE 1 X

ABBOTT LABS COM 002824100 $ 360 6,900 SH SOLE 1 X

ABERCROMBIE & FITCH CO CL A 002896207 $ 228 5,800 SH SOLE 1 X

ABRAXAS PETE CORP COM 003830106 $ 68 24,100 SH SOLE 1 X

ACERGY S A SPONSORED ADR 00443E104 $ 1,170 63,400 SH SOLE 1 X

ACTIVISION BLIZZARD INC COM 00507V109 $ 634 58,600 SH SOLE 1 X

ACXIOM CORP COM 005125109 $ 320 20,200 SH SOLE 1 X

ADVANCE AUTO PARTS INC COM 00751Y106 $ 434 7,400 SH SOLE 1 X

AEROPOSTALE COM 007865108 $ 270 11,600 SH SOLE 1 X

ADVANCED MICRO DEVICES

INC COM 007903107 $ 235 33,000 SH SOLE 1 X

ADVANCED MICRO DEVICES

INC COM 007903107 $ 7,003 985,000 SH PUT SOLE 1 X

ADVANCED ENERGY INDS COM 007973100 $ 184 14,100 SH SOLE 1 X

AETNA INC NEW COM 00817Y108 $ 291 9,200 SH SOLE 1 X

AIR TRANSPORT SERVICES

GRP INC COM 00922R105 $ 565 92,700 SH SOLE 1 X

AIRGAS INC COM 009363102 $ 1,114 16,400 SH SOLE 1 X

AKAMAI TECHNOLOGIES INC COM 00971T101 $ 10,506 209,364 SH SOLE 1 X

ALBEMARLE CORP COM 012653101 $ 239 5,100 SH SOLE 1 X

ALCOA INC COM 013817101 $ 167 13,800 SH SOLE 1 X

ALCATEL-LUCENT SPONSORED ADR 013904305 $ 142 42,100 SH SOLE 1 X

ALEXANDER & BALDWIN INC COM 014482103 $ 1,336 38,337 SH SHARED (OTHER) 1 X

ALERE INC COM 01449J105 $ 421 13,600 SH SOLE 1 X

ALEXION PHARMACEUTICALS

INC COM 015351109 $ 2,182 33,900 SH SOLE 1 X

ALLIANCE ONE INTL INC COM 018772103 $ 324 78,000 SH SOLE 1 X

ALLIANT ENERGY CORP COM 018802108 $ 538 14,800 SH SOLE 1 X

ALLIED NEVADA GOLD CORP COM 019344100 $ 54,887 2,072,215 SH SOLE 1 X

ALPHA NATURAL RESOURCES

INC COM 02076X102 $ 412 10,000 SH SOLE 1 X

AMAZON COM INC COM 023135106 $ 24,046 153,100 SH SOLE 1 X

AMERICAN AXLE & MFG

HLDGS INC COM 024061103 $ 7,667 850,000 SH SOLE 1 X

AMERICAN ELEC PWR INC COM 025537101 $ 399 11,000 SH SOLE 1 X

AMERICAN EAGLE OUTFITTERS

NEW COM 02553E106 $ 260 17,400 SH SOLE 1 X

AMERICAN EQTY INVT LIFE

HLD CO COM 025676206 $ 126 12,300 SH SOLE 1 X

AMERICAN OIL & GAS INC NEW COM 028723104 $ 6,480 800,000 SH SOLE 1 X

AMERICAN TOWER CORP CL A 029912201 $ 1,307 25,500 SH SOLE 1 X

AMERICAN WTR WKS CO

INC NEW COM 030420103 $ 584 25,100 SH SOLE 1 X

AMERISOURCEBERGEN CORP COM 03073E105 $ 3,333 108,700 SH SOLE 1 X

AMGEN INC COM 031162100 $ 265 4,800 SH SOLE 1 X

AMKOR TECHNOLOGY INC COM 031652100 $ 561 85,400 SH SOLE 1 X

AMYLIN PHARMACEUTICALS

INC COM 032346108 $ 4,170 200,000 SH CALL SOLE 1 X

ANADARKO PETE CORP COM 032511107 $ 981 17,200 SH SOLE 1 X

ANHEUSER BUSCH INBEV SA/NV SPONSORED ADR 03524A108 $ 295 5,024 SH SHARED (OTHER) 1 X

AON CORP COM 037389103 $ 239 6,100 SH SOLE 1 X

APACHE CORP COM 037411105 $ 596 6,100 SH SOLE 1 X

APOLLO GROUP INC CL A 037604105 $ 647 12,600 SH SOLE 1 X

APOLLO COML REAL EST

FIN INC COM 03762U105 $ 166 10,300 SH SOLE 1 X

APPLE INC COM 037833100 $ 70,252 247,584 SH SOLE 1 X

APPLE INC COM 037833100 $ 1,078 3,800 SH CALL SHARED (OTHER) 1 X

APPLIED INDL TECHNOLOGIES

INC COM 03820C105 $ 318 10,400 SH SOLE 1 X

APPLIED MATLS INC COM 038222105 $ 220 18,800 SH SOLE 1 X

ARCHER DANIELS MIDLAND CO COM 039483102 $ 354 11,100 SH SOLE 1 X

ARRIS GROUP INC COM 04269Q100 $ 263 26,900 SH SOLE 1 X

ARRIS GROUP INC SR NT CV 2%26 04269QAC4 $ 62,236 63,184,000 PRN SOLE 1 X

ARROW ELECTRS INC COM 042735100 $ 294 11,000 SH SOLE 1 X

ASHLAND INC NEW COM 044209104 $ 205 4,200 SH SOLE 1 X

ASSOCIATED ESTATES RLTY

CORP COM 045604105 $ 144 10,300 SH SOLE 1 X

ATHEROS COMMUNICATIONS

INC COM 04743P108 $ 379 14,400 SH SOLE 1 X

ATLAS AIR WORLDWIDE HLDGS

INC COM NEW 049164205 $ 221 4,400 SH SOLE 1 X

ATMOS ENERGY CORP COM 049560105 $ 433 14,800 SH SOLE 1 X

ATWOOD OCEANICS INC COM 050095108 $ 378 12,400 SH SOLE 1 X

AUTOLIV INC COM 052800109 $ 4,900 75,000 SH SOLE 1 X

AUTOMATIC DATA PROCESSING

INC COM 053015103 $ 693 16,500 SH SOLE 1 X

AUTOZONE INC COM 053332102 $ 206 900 SH SOLE 1 X

AVIS BUDGET GROUP COM 053774105 $ 329 28,200 SH SOLE 1 X

AVNET INC COM 053807103 $ 235 8,700 SH SOLE 1 X

BCE INC COM NEW 05534B760 $ 309 9,500 SH SHARED (OTHER) 1 X

BPZ RESOURCES INC COM 055639108 $ 22,397 5,847,875 SH SOLE 1 X

BMC SOFTWARE INC COM 055921100 $ 445 11,000 SH SOLE 1 X

BABCOCK & WILCOX CO NEW COM 05615F102 $ 1,591 74,750 SH SOLE 1 X

BAIDU INC SPON ADR REP A 056752108 $ 15,546 151,493 SH SOLE 1 X

BALDOR ELEC CO COM 057741100 $ 259 6,400 SH SOLE 1 X

BANCO MACRO SA SPON ADR B 05961W105 $ 223 5,000 SH SOLE 1 X

BANK OF AMERICA

CORPORATION COM 060505104 $ 1,632 124,500 SH SOLE 1 X

BANK OF NEW YORK MELLON

CORP COM 064058100 $ 240 9,200 SH SOLE 1 X

BANNER CORP COM 06652V109 $ 48 22,400 SH SOLE 1 X

BARD C R INC COM 067383109 $ 774 9,500 SH SOLE 1 X

BARCLAYS BK PLC IPATH S&P ST ETN 06740C527 $ 4,323 250,000 SH CALL SOLE 1 X

BARRICK GOLD CORP COM 067901108 $ 259 5,600 SH SOLE 1 X

BARRETT BILL CORP COM 06846N104 $ 277 7,700 SH SOLE 1 X

BAXTER INTL INC COM 071813109 $ 3,712 77,800 SH SOLE 1 X

BE AEROSPACE INC COM 073302101 $ 215 7,100 SH SOLE 1 X

BEAZER HOMES USA INC COM 07556Q105 $ 113 27,300 SH SOLE 1 X

BERKSHIRE HATHAWAY INC DEL CL A 084670108 $ 747 6 SH SOLE 1 X

BERKSHIRE HATHAWAY INC DEL CL B NEW 084670702 $ 541 6,545 SH SOLE 1 X

BIG LOTS INC COM 089302103 $ 236 7,100 SH SOLE 1 X

BIOGEN IDEC INC COM 09062X103 $ 325 5,800 SH SOLE 1 X

BIOFUEL ENERGY CORP COM 09064Y109 $ 97 48,800 SH SOLE 1 X

BLACKBOARD INC SR NT CV 3.25%27 091935AA4 $ 110,631 109,807,000 PRN SOLE 1 X

BLOCK H & R INC COM 093671105 $ 386 29,800 SH SOLE 1 X

BLOCK H & R INC COM 093671105 $ 2,075 160,265 SH SHARED (OTHER) 1 X

BLUEFLY INC COM NEW 096227301 $ 13,626 5,924,515 SH SOLE 1 X

BOISE INC COM 09746Y105 $ 178 27,400 SH SOLE 1 X

BOSTON SCIENTIFIC CORP COM 101137107 $ 558 91,100 SH SOLE 1 X

BRIDGEPOINT ED INC COM 10807M105 $ 241 15,600 SH SOLE 1 X

BRIGHAM EXPLORATION CO COM 109178103 $ 6,763 360,700 SH SOLE 1 X

BROADRIDGE FINL SOLUTIONS

INC COM 11133T103 $ 252 11,000 SH SOLE 1 X

BROCADE COMMUNICATIONS

SYS INC COM NEW 111621306 $ 60 10,200 SH SOLE 1 X

BROOKFIELD ASSET MGMT INC CL A LTD VT SH 112585104 $ 942 33,300 SH SOLE 1 X

BROOKFIELD ASSET MGMT INC CL A LTD VT SH 112585104 $ 681 24,000 SH SHARED (OTHER) 1 X

BROOKFIELD PPTYS CORP COM 112900105 $ 1,593 102,300 SH SOLE 1 X

BUCYRUS INTL INC NEW COM 118759109 $ 208 3,000 SH SOLE 1 X

CBL & ASSOC PPTYS INC COM 124830100 $ 146 11,200 SH SOLE 1 X

CBS CORP NEW CL B 124857202 $ 225 14,200 SH SOLE 1 X

C H ROBINSON WORLDWIDE

INC COM NEW 12541W209 $ 322 4,600 SH SOLE 1 X

CIGNA CORP COM 125509109 $ 1,066 29,800 SH SOLE 1 X

CIT GROUP INC COM NEW 125581801 $ 3,547 86,900 SH SOLE 1 X

CME GROUP INC COM 12572Q105 $ 2,269 8,712 SH SOLE 1 X

CMS ENERGY CORP COM 125896100 $ 429 23,800 SH SOLE 1 X

CNO FINL GROUP INC COM 12621E103 $ 233 42,100 SH SOLE 1 X

CSG SYS INTL INC COM 126349109 $ 18,121 994,000 SH SOLE 1 X

CSX CORP COM 126408103 $ 548 9,900 SH SOLE 1 X

CVS CAREMARK CORPORATION COM 126650100 $ 1,747 55,500 SH SOLE 1 X

CA INC COM 12673P105 $ 207 9,800 SH SOLE 1 X

CABLEVISION SYS CORP CL A NY CABLVS 12686C109 $ 10,352 395,263 SH SOLE 1 X

CABOT CORP COM 127055101 $ 430 13,200 SH SOLE 1 X

CACI INTL INC CL A 127190304 $ 661 14,600 SH SOLE 1 X

CADENCE DESIGN SYSTEM

INC COM 127387108 $ 382 50,000 SH SHARED (OTHER) 1 X

CADENCE DESIGN SYSTEM

INC SR NT CV1.375%11 127387AD0 $ 111,699 113,544,000 PRN SOLE 1 X

CADENCE DESIGN SYSTEM

INC SR NT CV 1.5%13 127387AF5 $ 93,586 100,901,000 PRN SOLE 1 X

CALGON CARBON CORP COM 129603106 $ 10,774 743,000 SH SOLE 1 X

CALLIDUS SOFTWARE INC COM 13123E500 $ 93 21,800 SH SOLE 1 X

CALPINE CORP COM NEW 131347304 $ 571 45,900 SH SOLE 1 X

CAMERON INTERNATIONAL

CORP COM 13342B105 $ 271 6,300 SH SOLE 1 X

CANADIAN NAT RES LTD COM 136385101 $ 862 24,900 SH SOLE 1 X

CAPITAL ONE FINL CORP COM 14040H105 $ 305 7,700 SH SOLE 1 X

CAPITALSOURCE INC COM 14055X102 $ 1,125 210,700 SH SOLE 1 X

CARDINAL HEALTH INC COM 14149Y108 $ 638 19,300 SH SOLE 1 X

CARDIOME PHARMA CORP COM NEW 14159U202 $ 64 10,500 SH SOLE 1 X

CARDIOVASCULAR SYS INC

DEL COM 141619106 $ 780 148,780 SH SHARED (OTHER) 1 X

CAREFUSION CORP COM 14170T101 $ 546 22,000 SH SOLE 1 X

CARMAX INC COM 143130102 $ 418 15,000 SH SOLE 1 X

CARTER INC COM 146229109 $ 495 18,800 SH SOLE 1 X

CASUAL MALE RETAIL GRP

INC COM NEW 148711302 $ 95 23,200 SH SOLE 1 X

CATHAY GENERAL BANCORP COM 149150104 $ 203 17,100 SH SOLE 1 X

CELANESE CORP DEL COM SER A 150870103 $ 209 6,500 SH SOLE 1 X

CELGENE CORP COM 151020104 $ 478 8,300 SH SOLE 1 X

CENTERPOINT ENERGY INC COM 15189T107 $ 567 36,100 SH SOLE 1 X

CENTURYLINK INC COM 156700106 $ 60,934 1,544,193 SH SOLE 1 X

CEPHALON INC COM 156708109 $ 225 3,600 SH SOLE 1 X

CENVEO INC COM 15670S105 $ 88 17,400 SH SOLE 1 X

CERADYNE INC SR SUB NT CV 35 156710AA3 $ 71,634 72,085,000 PRN SOLE 1 X

CHARLES RIV LABS INTL INC COM 159864107 $ 779 23,500 SH SOLE 1 X

CHESAPEAKE ENERGY CORP COM 165167107 $ 439 19,400 SH SOLE 1 X

CHEVRON CORP NEW COM 166764100 $ 203 2,500 SH SOLE 1 X

CHIMERA INVT CORP COM 16934Q109 $ 75 18,900 SH SOLE 1 X

CHIPOTLE MEXICAN GRILL

INC COM 169656105 $ 3,698 21,500 SH SOLE 1 X

CIENA CORP COM NEW 171779309 $ 114 7,300 SH SOLE 1 X

CIENA CORP SR NT CV 0.25%13 171779AB7 $ 1,796 2,000,000 PRN SOLE 1 X

CIMAREX ENERGY CO COM 171798101 $ 232 3,500 SH SOLE 1 X

CISCO SYS INC COM 17275R102 $ 543 24,800 SH SOLE 1 X

CITIGROUP INC COM 172967101 $ 2,085 534,500 SH SOLE 1 X

CITI TRENDS INC COM 17306X102 $ 33,523 1,384,686 SH SOLE 1 X

CITRIX SYS INC COM 177376100 $ 546 8,000 SH SOLE 1 X

CLEAR CHANNEL OUTDOOR

HLDGS IN CL A 18451C109 $ 122 10,700 SH SOLE 1 X

CLEARWIRE CORP NEW CL A 18538Q105 $ 1,868 230,879 SH SOLE 1 X

CLIFFS NATURAL RESOURCES INC COM 18683K101 $ 454 7,100 SH SOLE 1 X

COACH INC COM 189754104 $ 17,330 403,400 SH SOLE 1 X

CNINSURE INC SPONSORED ADR 18976M103 $ 3,065 131,158 SH SOLE 1 X

COCA COLA CO COM 191216100 $ 410 7,000 SH SOLE 1 X

COCA COLA ENTERPRISES INC COM 191219104 $ 5,313 171,400 SH SOLE 1 X

COGNIZANT TECHNOLOGY

SOLUTIONS CL A 192446102 $ 4,371 67,800 SH SOLE 1 X

COHEN & STEERS INC COM 19247A100 $ 503 23,160 SH SHARED (OTHER) 1 X

COINSTAR INC COM 19259P300 $ 774 18,000 SH SOLE 1 X

COLLECTIVE BRANDS INC COM 19421W100 $ 257 15,900 SH SOLE 1 X

COMCAST CORP NEW CL A 20030N101 $ 16,883 933,811 SH SOLE 1 X

COMCAST CORP NEW CL A SPL 20030N200 $ 538 31,600 SH SOLE 1 X

COMMSCOPE INC COM 203372107 $ 69,137 2,912,272 SH SOLE 1 X

COMPLETE PRODUCTION

SERVICES COM 20453E109 $ 364 17,800 SH SOLE 1 X

COMPUWARE CORP COM 205638109 $ 443 52,000 SH SOLE 1 X

CONOCOPHILLIPS COM 20825C104 $ 574 10,000 SH SOLE 1 X

CONSOL ENERGY INC COM 20854P109 $ 554 15,000 SH SOLE 1 X

CONSTELLATION BRANDS INC CL A 21036P108 $ 193 10,900 SH SOLE 1 X

CONVERGYS CORP COM 212485106 $ 296 28,300 SH SOLE 1 X

COOPER TIRE & RUBR CO COM 216831107 $ 13,982 712,302 SH SOLE 1 X

CORELOGIC INC COM 21871D103 $ 301 15,700 SH SOLE 1 X

CORINTHIAN COLLEGES INC COM 218868107 $ 132 18,800 SH SOLE 1 X

CORN PRODS INTL INC COM 219023108 $ 278 7,400 SH SOLE 1 X

CORNING INC COM 219350105 $ 241 13,200 SH SOLE 1 X

CORRECTIONS CORP AMER

NEW COM NEW 22025Y407 $ 738 29,900 SH SOLE 1 X

COSTCO WHSL CORP NEW COM 22160K105 $ 329 5,100 SH SOLE 1 X

COVANCE INC COM 222816100 $ 299 6,400 SH SOLE 1 X

COVANTA HLDG CORP COM 22282E102 $ 31,064 1,972,300 SH SOLE 1 X

COVANTA HLDG CORP SR DEB CV 1%27 22282EAA0 $ 38,041 39,319,000 PRN SOLE 1 X

COWEN GROUP INC NEW CL A 223622101 $ 89 27,200 SH SOLE 1 X

CROWN CASTLE INTL CORP COM 228227104 $ 614 13,900 SH SOLE 1 X

CROWN HOLDINGS INC COM 228368106 $ 6,580 229,600 SH SOLE 1 X

CTRIP COM INTL LTD AMERICAN DEP SHS 22943F100 $ 4,324 90,550 SH SOLE 1 X

CYTEC INDS INC COM 232820100 $ 361 6,400 SH SOLE 1 X

DG FASTCHANNEL INC COM 23326R109 $ 278 12,800 SH SOLE 1 X

DANA HLDG CORP COM 235825205 $ 1,561 126,700 SH SOLE 1 X

DANAHER CORP DEL COM 235851102 $ 268 6,600 SH SOLE 1 X

DAVITA INC COM 23918K108 $ 1,070 15,500 SH SOLE 1 X

DECKERS OUTDOOR CORP COM 243537107 $ 275 5,500 SH SOLE 1 X

DEL MONTE FOODS CO COM 24522P103 $ 190 14,500 SH SOLE 1 X

DELCATH SYS INC COM 24661P104 $ 142 19,600 SH SOLE 1 X

DELIA’S INC NEW COM 246911101 $ 73 38,700 SH SOLE 1 X

DELL INC COM 24702R101 $ 183 14,100 SH SOLE 1 X

DELTA AIR LINES INC DEL COM NEW 247361702 $ 42,963 3,691,000 SH SOLE 1 X

DEMANDTEC INC COM NEW 24802R506 $ 4,787 508,766 SH SOLE 1 X

DENDREON CORP COM 24823Q107 $ 74,802 1,816,463 SH SOLE 1 X

DEPOMED INC COM 249908104 $ 104 23,200 SH SOLE 1 X

DEVELOPERS DIVERSIFIED

RLTY CO COM 251591103 $ 199 17,700 SH SOLE 1 X

DEVON ENERGY CORP NEW COM 25179M103 $ 3,833 59,200 SH SOLE 1 X

DEXCOM INC COM 252131107 $ 186 14,100 SH SOLE 1 X

DIEBOLD INC COM 253651103 $ 236 7,600 SH SOLE 1 X

DIGITAL RIV INC COM 25388B104 $ 272 8,000 SH SOLE 1 X

DIODES INC COM 254543101 $ 125 7,300 SH SOLE 1 X

DIODES INC SR CV NT 2.25%26 254543AA9 $ 100,559 100,059,000 PRN SOLE 1 X

DISCOVERY COMMUNICATNS

NEW COM SER A 25470F104 $ 144 3,300 SH SOLE 1 X

DISCOVERY COMMUNICATNS

NEW COM SER C 25470F302 $ 1,509 39,500 SH SOLE 1 X

DIRECTV COM CL A 25490A101 $ 39,513 949,153 SH SOLE 1 X

DIRECTV COM CL A 25490A101 $ 3,330 80,000 SH CALL SOLE 1 X

DOLLAR THRIFTY AUTOMOTIVE

GP COM 256743105 $ 471 9,400 SH SOLE 1 X

DOLLAR TREE INC COM 256746108 $ 697 14,300 SH SOLE 1 X

DOMINOS PIZZA INC COM 25754A201 $ 140 10,600 SH SOLE 1 X

DOMTAR CORP COM NEW 257559203 $ 1,085 16,800 SH SOLE 1 X

DONNELLEY R R & SONS CO COM 257867101 $ 370 21,800 SH SOLE 1 X

DOUGLAS EMMETT INC COM 25960P109 $ 184 10,500 SH SOLE 1 X

DOVER CORP COM 260003108 $ 230 4,400 SH SOLE 1 X

DOW CHEM CO COM 260543103 $ 42,593 1,551,100 SH SOLE 1 X

DR PEPPER SNAPPLE GROUP

INC COM 26138E109 $ 391 11,000 SH SOLE 1 X

DRESSER-RAND GROUP INC COM 261608103 $ 347 9,400 SH SOLE 1 X

E HOUSE CHINA HLDGS LTD ADR 26852W103 $ 1,679 88,980 SH SOLE 1 X

E M C CORP MASS COM 268648102 $ 325 16,000 SH SOLE 1 X

EPIQ SYS INC COM 26882D109 $ 196 16,000 SH SOLE 1 X

E TRADE FINANCIAL CORP COM NEW 269246401 $ 368 25,300 SH SOLE 1 X

EARTHLINK INC COM 270321102 $ 225 24,800 SH SOLE 1 X

EASTMAN CHEM CO COM 277432100 $ 481 6,500 SH SOLE 1 X

EBAY INC COM 278642103 $ 2,179 89,300 SH SOLE 1 X

ECHOSTAR CORP CL A 278768106 $ 347 18,200 SH SOLE 1 X

EDISON INTL COM 281020107 $ 337 9,800 SH SOLE 1 X

EINSTEIN NOAH REST GROUP

INC COM 28257U104 $ 190 17,900 SH SOLE 1 X

EL PASO CORP COM 28336L109 $ 776 62,700 SH SOLE 1 X

ELECTRONIC ARTS INC COM 285512109 $ 302 18,356 SH SHARED (OTHER) 1 X

EMCOR GROUP INC COM 29084Q100 $ 563 22,900 SH SOLE 1 X

EMDEON INC CL A 29084T104 $ 94,848 7,787,218 SH SOLE 1 X

EMULEX CORP COM NEW 292475209 $ 237 22,700 SH SOLE 1 X

ENCANA CORP COM 292505104 $ 278 9,200 SH SOLE 1 X

ENCORE CAP GROUP INC COM 292554102 $ 243 13,500 SH SOLE 1 X

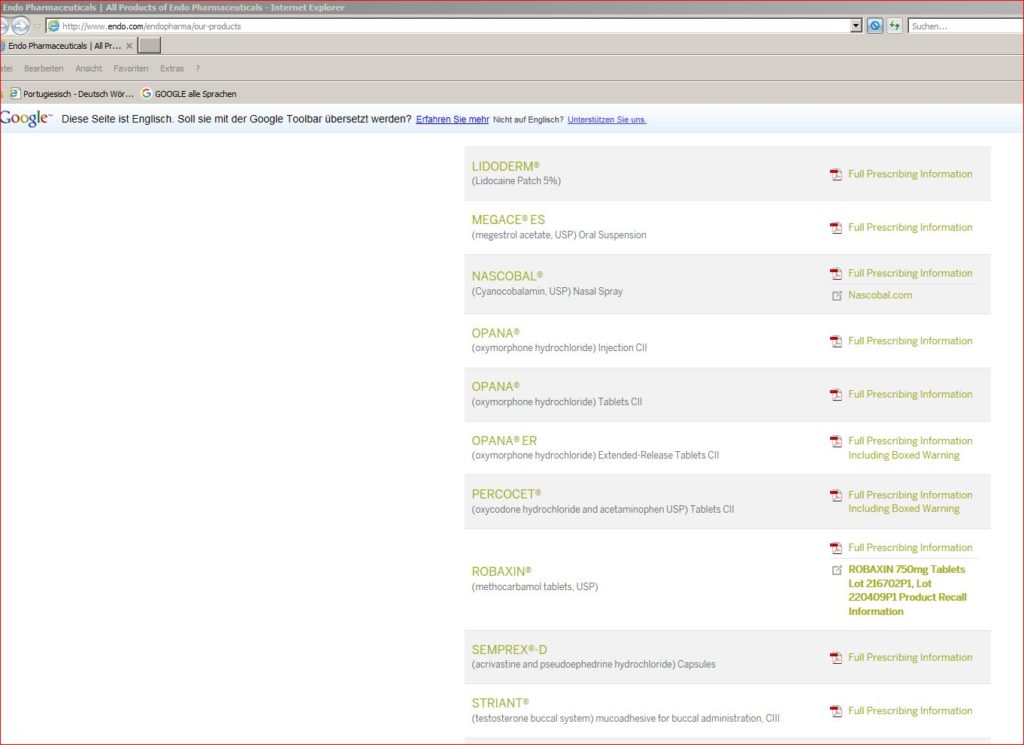

ENDO PHARMACEUTICALS (Opiate)

HLDGS INC COM 29264F205 $ 392 11,800 SH SOLE 1 X

ENERGEN CORP COM 29265N108 $ 407 8,900 SH SOLE 1 X

ENERGIZER HLDGS INC COM 29266R108 $ 356 5,300 SH SOLE 1 X

ENERGYSOLUTIONS INC COM 292756202 $ 83 16,500 SH SOLE 1 X

ENSCO PLC SPONSORED ADR 29358Q109 $ 537 12,000 SH SOLE 1 X

ENTERGY CORP NEW COM 29364G103 $ 245 3,200 SH SOLE 1 X

ENZON PHARMACEUTICALS

INC COM 293904108 $ 752 66,900 SH SOLE 1 X

EPICOR SOFTWARE CORP SR NT CV2.375%27 29426LAA6 $ 141,179 149,002,000 PRN SOLE 1 X

EQUIFAX INC COM 294429105 $ 540 17,300 SH SOLE 1 X

ERICSSON L M TEL CO ADR B SEK 10 294821608 $ 179 16,300 SH SOLE 1 X

EURONET WORLDWIDE INC SR DB CV 3.5% 25 298736AF6 $ 14,061 14,311,000 PRN SOLE 1 X

EXAR CORP COM 300645108 $ 38,136 6,366,666 SH SOLE 1 X

EXELON CORP COM 30161N101 $ 319 7,500 SH SOLE 1 X

EXELON CORP COM 30161N101 $ 809 19,000 SH SHARED (OTHER) 1 X

EXETER RES CORP COM 301835104 $ 2,198 338,651 SH SHARED (OTHER) 1 X

EXPEDIA INC DEL COM 30212P105 $ 863 30,600 SH SOLE 1 X

EXPRESS SCRIPTS INC COM 302182100 $ 10,717 220,053 SH SOLE 1 X

EXTERRAN HLDGS INC COM 30225X103 $ 254 11,200 SH SOLE 1 X

EXTREME NETWORKS INC COM 30226D106 $ 27,264 8,766,666 SH SOLE 1 X

EXXON MOBIL CORP COM 30231G102 $ 513 8,300 SH SOLE 1 X

FEI CO SB NT CV2.875%13 30241LAF6 $ 20,641 20,236,000 PRN SOLE 1 X

FLIR SYS INC COM 302445101 $ 378 14,700 SH SOLE 1 X

FAIRCHILD SEMICONDUCTOR

INTL COM 303726103 $ 234 24,900 SH SOLE 1 X

FEMALE HEALTH CO COM 314462102 $ 6,798 1,319,931 SH SOLE 1 X

FIDELITY NATL INFORMATION

SVCS COM 31620M106 $ 2,889 106,500 SH SOLE 1 X

FIFTH THIRD BANCORP COM 316773100 $ 10,281 854,600 SH SOLE 1 X

FINISH LINE INC CL A 317923100 $ 380 27,300 SH SOLE 1 X

FIRST CASH FINL SVCS INC COM 31942D107 $ 402 14,500 SH SOLE 1 X

FIRST NIAGARA FINL GP INC COM 33582V108 $ 147 12,600 SH SOLE 1 X

FIRST SOLAR INC COM 336433107 $ 9,180 62,300 SH SOLE 1 X

FISERV INC COM 337738108 $ 560 10,400 SH SOLE 1 X

FIRSTMERIT CORP COM 337915102 $ 200 10,900 SH SOLE 1 X

FLAMEL TECHNOLOGIES SA SPONSORED ADR 338488109 $ 95 13,100 SH SOLE 1 X

FLOWSERVE CORP COM 34354P105 $ 427 3,900 SH SOLE 1 X

FORD MTR CO DEL COM PAR $0.01 345370860 $ 436 35,600 SH SOLE 1 X

FOREST CITY ENTERPRISES INC CL A 345550107 $ 1,088 84,822 SH SHARED (OTHER) 1 X

FOREST LABS INC COM 345838106 $ 513 16,600 SH SOLE 1 X

FREEPORT-MCMORAN COPPER

& GOLD COM 35671D857 $ 316 3,700 SH SOLE 1 X

FRONTIER COMMUNICATIONS

CORP COM 35906A108 $ 6,651 814,129 SH SOLE 1 X

GSI COMMERCE INC COM 36238G102 $ 215 8,700 SH SOLE 1 X

GAMMON GOLD INC COM 36467T106 $ 4,542 647,980 SH SHARED (OTHER) 1 X

GENERAL CABLE CORP DEL NEW COM 369300108 $ 3,024 111,500 SH SOLE 1 X

GENERAL DYNAMICS CORP COM 369550108 $ 201 3,200 SH SOLE 1 X

GENWORTH FINL INC COM CL A 37247D106 $ 220 18,000 SH SOLE 1 X

GILEAD SCIENCES INC COM 375558103 $ 12,083 339,310 SH SOLE 1 X

GLOBAL CROSSING LTD SR NT CV 5%11 37932JAA1 $ 36,187 35,900,000 PRN SOLE 1 X

GLOBAL PMTS INC COM 37940X102 $ 227 5,300 SH SOLE 1 X

GLOBAL GEOPHYSICAL SVCS INC COM 37946S107 $ 6,890 945,100 SH SOLE 1 X

GOLDMAN SACHS GROUP INC COM 38141G104 $ 651 4,500 SH SOLE 1 X

GOODRICH CORP COM 382388106 $ 4,571 62,000 SH SOLE 1 X

GOODYEAR TIRE & RUBR CO COM 382550101 $ 161 15,000 SH SOLE 1 X

GOOGLE INC CL A 38259P508 $ 40,154 76,368 SH SOLE 1 X

GRAN TIERRA ENERGY INC COM 38500T101 $ 7,720 1,000,000 SH SOLE 1 X

GRAPHIC PACKAGING HLDG CO COM 388689101 $ 60 18,000 SH SOLE 1 X

GREAT BASIN GOLD LTD COM 390124105 $ 9,188 3,750,000 SH SOLE 1 X

GREAT BASIN GOLD LTD COM 390124105 $ 5,404 2,205,520 SH SHARED (OTHER) 1 X

HSN INC COM 404303109 $ 395 13,200 SH SOLE 1 X

HALLIBURTON CO COM 406216101 $ 7,130 215,600 SH SOLE 1 X

HARRIS CORP DEL COM 413875105 $ 332 7,500 SH SOLE 1 X

HARSCO CORP COM 415864107 $ 209 8,500 SH SOLE 1 X

HARTFORD FINL SVCS GROUP

INC COM 416515104 $ 475 20,700 SH SOLE 1 X

HARVEST NATURAL RESOURCES

INC COM 41754V103 $ 6,128 588,100 SH SOLE 1 X

HASBRO INC COM 418056107 $ 245 5,500 SH SOLE 1 X

HAWAIIAN HOLDINGS INC COM 419879101 $ 101 16,900 SH SOLE 1 X

HEALTHSOUTH CORP COM NEW 421924309 $ 2,669 139,000 SH SOLE 1 X

HEALTH MGMT ASSOC INC NEW CL A 421933102 $ 90 11,700 SH SOLE 1 X

HEADWATERS INC COM 42210P102 $ 5,040 1,400,000 SH SOLE 1 X

HEALTH NET INC COM 42222G108 $ 938 34,500 SH SOLE 1 X

HEALTHSPRING INC COM 42224N101 $ 248 9,600 SH SOLE 1 X

HEARTLAND EXPRESS INC COM 422347104 $ 161 10,800 SH SOLE 1 X

HELMERICH & PAYNE INC COM 423452101 $ 202 5,000 SH SOLE 1 X

HERSHA HOSPITALITY TR SH BEN INT A 427825104 $ 119 22,900 SH SOLE 1 X

HERTZ GLOBAL HOLDINGS INC COM 42805T105 $ 546 51,600 SH SOLE 1 X

HESS CORP COM 42809H107 $ 958 16,200 SH SOLE 1 X

HEWLETT PACKARD CO COM 428236103 $ 3,605 85,700 SH SOLE 1 X

HOLOGIC INC COM 436440101 $ 263 16,400 SH SOLE 1 X

HOME DEPOT INC COM 437076102 $ 624 19,700 SH SOLE 1 X

HONEYWELL INTL INC COM 438516106 $ 242 5,500 SH SOLE 1 X

HOSPIRA INC COM 441060100 $ 12,867 225,700 SH SOLE 1 X

HUMANA INC COM 444859102 $ 879 17,500 SH SOLE 1 X

HUNTSMAN CORP COM 447011107 $ 203 17,600 SH SOLE 1 X

ICONIX BRAND GROUP INC COM 451055107 $ 299 17,100 SH SOLE 1 X

IMMUCOR INC COM 452526106 $ 904 45,600 SH SOLE 1 X

INGRAM MICRO INC CL A 457153104 $ 479 28,400 SH SOLE 1 X

INSPIRE PHARMACEUTICALS

INC COM 457733103 $ 980 164,725 SH SOLE 1 X

INTEGRATED DEVICE

TECHNOLOGY COM 458118106 $ 621 106,100 SH SOLE 1 X

INTEL CORP COM 458140100 $ 968 50,400 SH SOLE 1 X

INTERNATIONAL BUSINESS

MACHS COM 459200101 $ 523 3,900 SH SOLE 1 X

INTERNATIONAL COAL GRP

INC NEW COM 45928H106 $ 488 91,700 SH SOLE 1 X

INTERPUBLIC GROUP COS INC COM 460690100 $ 192 19,100 SH SOLE 1 X

INTERSIL CORP CL A 46069S109 $ 254 21,700 SH SOLE 1 X

INTEROIL CORP COM 460951106 $ 275,295 4,022,422 SH SOLE 1 X

INTEROIL CORP COM 460951106 $ 17,110 250,000 SH CALL SOLE 1 X

INTERVAL LEISURE GROUP

INC COM 46113M108 $ 244 18,100 SH SOLE 1 X

ION GEOPHYSICAL CORP COM 462044108 $ 134 26,100 SH SOLE 1 X

ISHARES GOLD TRUST ISHARES 464285105 $ 64,000 5,000,000 SH SOLE 1 X

ISHARES TR MSCI EMERG MKT 464287234 $ 121 2,700 SH SOLE 1 X

ISHARES TR MSCI EMERG MKT 464287234 $ 106,888 2,387,500 SH PUT SOLE 1 X

ISHARES TR RUSSELL 2000 464287655 $ 115,425 1,710,000 SH PUT SOLE 1 X

ISHARES TR DJ US TELECOMM 464287713 $ 8,659 397,401 SH SOLE 1 X

ITAU UNIBANCO HLDG SA SPON ADR REP PFD 465562106 $ 213 8,800 SH SOLE 1 X

ITC HLDGS CORP COM 465685105 $ 380 6,100 SH SOLE 1 X

JDS UNIPHASE CORP COM PAR $0.001 46612J507 $ 123 9,900 SH SOLE 1 X

JDS UNIPHASE CORP SR NT CV 1%26 46612JAD3 $ 118,529 125,428,000 PRN SOLE 1 X

JDA SOFTWARE GROUP INC COM 46612K108 $ 271 10,700 SH SOLE 1 X

JPMORGAN CHASE & CO COM 46625H100 $ 28,579 750,700 SH SOLE 1 X

JACK IN THE BOX INC COM 466367109 $ 645 30,100 SH SOLE 1 X

JAGUAR MNG INC COM 47009M103 $ 6,065 933,126 SH SHARED (OTHER) 1 X

JARDEN CORP COM 471109108 $ 408 13,100 SH SOLE 1 X

JETBLUE AIRWAYS CORP COM 477143101 $ 1,889 282,400 SH SOLE 1 X

JO-ANN STORES INC COM 47758P307 $ 267 6,000 SH SOLE 1 X

JOHNSON & JOHNSON COM 478160104 $ 260 4,200 SH SOLE 1 X

JONES APPAREL GROUP INC COM 480074103 $ 365 18,600 SH SOLE 1 X

KBR INC COM 48242W106 $ 303 12,300 SH SOLE 1 X

KAPSTONE PAPER &

PACKAGING CRP COM 48562P103 $ 146 12,000 SH SOLE 1 X

KAYDON CORP COM 486587108 $ 349 10,100 SH SOLE 1 X

KINETIC CONCEPTS INC COM NEW 49460W208 $ 402 11,000 SH SOLE 1 X

KING PHARMACEUTICALS INC COM 495582108 $ 165 16,600 SH SOLE 1 X

KINROSS GOLD CORP COM NO PAR 496902404 $ 72,597 3,863,600 SH SOLE 1 X

KNIGHT CAP GROUP INC CL A COM 499005106 $ 142 11,500 SH SOLE 1 X

KOHLS CORP COM 500255104 $ 321 6,100 SH SOLE 1 X

KRAFT FOODS INC CL A 50075N104 $ 1,688 54,700 SH SOLE 1 X

KRATON PERFORMANCE

POLYMERS COM 50077C106 $ 9,598 353,500 SH SOLE 1 X

KROGER CO COM 501044101 $ 561 25,900 SH SOLE 1 X

KULICKE & SOFFA INDS INC COM 501242101 $ 98 15,800 SH SOLE 1 X

L-1 IDENTITY SOLUTIONS INC COM 50212A106 $ 443 37,800 SH SOLE 1 X

LSI CORPORATION COM 502161102 $ 221 48,500 SH SOLE 1 X

L-3 COMMUNICATIONS

HLDGS INC COM 502424104 $ 238 3,300 SH SOLE 1 X

LAM RESEARCH CORP COM 512807108 $ 1,297 31,000 SH SOLE 1 X

LATTICE SEMICONDUCTOR

CORP COM 518415104 $ 365 76,900 SH SOLE 1 X

LAUDER ESTEE COS INC CL A 518439104 $ 550 8,700 SH SOLE 1 X

LAWSON SOFTWARE INC NEW COM 52078P102 $ 49,775 5,876,666 SH SOLE 1 X

LAWSON SOFTWARE INC NEW SR NT CV 2.5%12 52078PAA0 $ 218,071 213,795,000 PRN SOLE 1 X

LEAP WIRELESS INTL INC COM NEW 521863308 $ 2,215 179,335 SH SOLE 1 X

LEAR CORP COM NEW 521865204 $ 5,186 65,700 SH SOLE 1 X

LENDER PROCESSING

SVCS INC COM 52602E102 $ 671 20,200 SH SOLE 1 X

LENNAR CORP CL A 526057104 $ 215 14,000 SH SOLE 1 X

LEUCADIA NATL CORP COM 527288104 $ 612 25,900 SH SOLE 1 X

LEXINGTON REALTY TRUST COM 529043101 $ 143 20,000 SH SOLE 1 X

LIBERTY GLOBAL INC COM SER A 530555101 $ 527 17,100 SH SOLE 1 X

LIBERTY GLOBAL INC COM SER C 530555309 $ 171 5,600 SH SOLE 1 X

LIBERTY MEDIA CORP NEW INT COM SER A 53071M104 $ 447 32,600 SH SOLE 1 X

LIBERTY MEDIA CORP NEW CAP COM SER A 53071M302 $ 1,098 21,100 SH SOLE 1 X

LIBERTY MEDIA CORP NEW LIB STAR COM A 53071M708 $ 13,401 206,550 SH SOLE 1 X

LIFE TECHNOLOGIES CORP COM 53217V109 $ 1,237 26,500 SH SOLE 1 X

LIFEPOINT HOSPITALS INC COM 53219L109 $ 280 8,000 SH SOLE 1 X

LINCARE HLDGS INC COM 532791100 $ 396 15,800 SH SOLE 1 X

LINEAR TECHNOLOGY CORP COM 535678106 $ 108 3,500 SH SOLE 1 X

LINEAR TECHNOLOGY CORP SR CV 3.125%27 535678AD8 $ 219,800 219,252,000 PRN SOLE 1 X

LIONBRIDGE TECHNOLOGIES

INC COM 536252109 $ 105 24,400 SH SOLE 1 X

LIVE NATION

ENTERTAINMENT INC COM 538034109 $ 672 68,000 SH SOLE 1 X

LOCKHEED MARTIN CORP COM 539830109 $ 862 12,100 SH SOLE 1 X

LOGMEIN INC COM 54142L109 $ 2,058 57,203 SH SOLE 1 X

LONGTOP FINL

TECHNOLOGIES LTD ADR 54318P108 $ 10,853 275,800 SH SOLE 1 X

LORAL SPACE &

COMMUNICATNS INC COM 543881106 $ 3,459 66,266 SH SOLE 1 X

LORILLARD INC COM 544147101 $ 578 7,200 SH SOLE 1 X

LOWES COS INC COM 548661107 $ 432 19,400 SH SOLE 1 X

LOWES COS INC COM 548661107 $ 22,123 992,500 SH CALL SOLE 1 X

LUBRIZOL CORP COM 549271104 $ 477 4,500 SH SOLE 1 X

MBIA INC COM 55262C100 $ 1,103 109,800 SH SOLE 1 X

MEMC ELECTR MATLS INC COM 552715104 $ 7,152 600,000 SH SOLE 1 X

MFA FINANCIAL INC COM 55272X102 $ 340 44,500 SH SOLE 1 X

MGM RESORTS

INTERNATIONAL COM 552953101 $ 4,072 361,000 SH PUT SOLE 1 X

MI DEVS INC CL A SUB VTG 55304X104 $ 360 32,800 SH SOLE 1 X

MPG OFFICE TR INC COM 553274101 $ 263 105,000 SH SOLE 1 X

MSCI INC CL A 55354G100 $ 379 11,400 SH SOLE 1 X

MSCI INC CL A 55354G100 $ 559 16,825 SH SHARED (OTHER) 1 X

MACK CALI RLTY CORP COM 554489104 $ 203 6,200 SH SOLE 1 X

MACYS INC COM 55616P104 $ 912 39,500 SH SOLE 1 X

MADISON SQUARE

GARDEN INC CL A 55826P100 $ 3,024 143,475 SH SOLE 1 X

MAGNA INTL INC COM 559222401 $ 821 10,000 SH SOLE 1 X

MANITOWOC INC COM 563571108 $ 281 23,200 SH SOLE 1 X

MANPOWER INC COM 56418H100 $ 402 7,700 SH SOLE 1 X

MANTECH INTL CORP CL A 564563104 $ 289 7,300 SH SOLE 1 X

MAP PHARMACEUTICALS

INC COM 56509R108 $ 27,940 1,826,169 SH SHARED (OTHER) 1 X

MARATHON OIL CORP COM 565849106 $ 298 9,000 SH SOLE 1 X

MARKEL CORP COM 570535104 $ 591 1,715 SH SOLE 1 X

MARKETAXESS HLDGS INC COM 57060D108 $ 277 16,300 SH SOLE 1 X

MARKET VECTORS ETF TR GOLD MINER ETF 57060U100 $ 755 13,500 SH SOLE 1 X

MASCO CORP COM 574599106 $ 128 11,600 SH SOLE 1 X

MASSEY ENERGY COMPANY COM 576206106 $ 32,912 1,061,000 SH SOLE 1 X

MASTEC INC COM 576323109 $ 106 10,300 SH SOLE 1 X

MASTERCARD INC CL A 57636Q104 $ 3,065 13,681 SH SOLE 1 X

MASTERCARD INC CL A 57636Q104 $ 1,658 7,400 SH SHARED (OTHER) 1 X

MATTEL INC COM 577081102 $ 221 9,400 SH SOLE 1 X

MAXIM INTEGRATED

PRODS INC COM 57772K101 $ 224 12,100 SH SOLE 1 X

MCAFEE INC COM 579064106 $ 269 5,700 SH SOLE 1 X

MCDERMOTT INTL INC COM 580037109 $ 1,819 123,100 SH SOLE 1 X

MCDONALDS CORP COM 580135101 $ 924 12,400 SH SOLE 1 X

MCKESSON CORP COM 58155Q103 $ 3,732 60,400 SH SOLE 1 X

MEAD JOHNSON

NUTRITION CO COM 582839106 $ 4,880 85,744 SH SOLE 1 X

MEDCO HEALTH

SOLUTIONS INC COM 58405U102 $ 323 6,200 SH SOLE 1 X

MEDICIS PHARMACEUTICAL

CORP CL A NEW 584690309 $ 219 7,400 SH SOLE 1 X

MEDIFAST INC COM 58470H101 $ 203 7,500 SH SOLE 1 X

MEDNAX INC COM 58502B106 $ 341 6,400 SH SOLE 1 X

MELCO CROWN

ENTMT LTD ADR 585464100 $ 2,648 520,301 SH SOLE 1 X

MENTOR GRAPHICS CORP SB DB CV 6.25%26 587200AF3 $ 79,535 76,476,000 PRN SOLE 1 X

MERCADOLIBRE INC COM 58733R102 $ 7,593 105,200 SH SOLE 1 X

MERCK & CO INC NEW COM 58933Y105 $ 405 11,000 SH SOLE 1 X

MERCURY

COMPUTER SYS COM 589378108 $ 20,878 1,735,466 SH SOLE 1 X

METHANEX CORP COM 59151K108 $ 569 23,200 SH SOLE 1 X

METROPCS COMMUNICATIONS

INC COM 591708102 $ 337 32,200 SH SOLE 1 X

METTLER TOLEDO

INTERNATIONAL COM 592688105 $ 3,833 30,800 SH SOLE 1 X

MICREL INC COM 594793101 $ 144 14,600 SH SOLE 1 X

MICROS SYS INC COM 594901100 $ 233 5,500 SH SOLE 1 X

MICROSOFT CORP COM 594918104 $ 3,343 136,500 SH SOLE 1 X

MICRON TECHNOLOGY INC COM 595112103 $ 311 43,100 SH SOLE 1 X

MINDRAY MEDICAL INTL

LTD SPON ADR 602675100 $ 11,089 375,000 SH SOLE 1 X

MINEFINDERS LTD COM 602900102 $ 5,779 589,129 SH SHARED (OTHER) 1 X

MINERALS TECHNOLOGIES INC COM 603158106 $ 1,084 18,400 SH SOLE 1 X

MOHAWK INDS INC COM 608190104 $ 240 4,500 SH SOLE 1 X

MONSANTO CO NEW COM 61166W101 $ 312,638 6,522,804 SH SOLE 1 X (Glyphosat)

MONSTER WORLDWIDE INC COM 611742107 $ 537 41,400 SH SOLE 1 X

MOODYS CORP COM 615369105 $ 195 7,800 SH SOLE 1 X

MOODYS CORP COM 615369105 $ 1,786 71,500 SH CALL SOLE 1 X

MORGAN STANLEY COM NEW 617446448 $ 659 26,700 SH SOLE 1 X

MOSAIC CO COM 61945A107 $ 47,596 810,000 SH CALL SOLE 1 X

MOTOROLA INC COM 620076109 $ 1,134 132,900 SH SOLE 1 X

MOTOROLA INC COM 620076109 $ 1,464 171,600 SH CALL SOLE 1 X

MULTIMEDIA GAMES INC COM 625453105 $ 52 14,000 SH SOLE 1 X

MURPHY OIL CORP COM 626717102 $ 1,461 23,600 SH SOLE 1 X

MYLAN INC COM 628530107 $ 192 10,200 SH SOLE 1 X

MYRIAD GENETICS INC COM 62855J104 $ 194 11,800 SH SOLE 1 X

NCI BUILDING SYS INC COM NEW 628852204 $ 2,859 300,000 SH SOLE 1 X

NCR CORP NEW COM 62886E108 $ 236 17,300 SH SOLE 1 X

NII HLDGS INC CL B NEW 62913F201 $ 617 15,000 SH SOLE 1 X

NVR INC COM 62944T105 $ 887 1,370 SH SOLE 1 X

NABI

BIOPHARMACEUTICALS COM 629519109 $ 113 23,500 SH SOLE 1 X

NALCO HOLDING COMPANY COM 62985Q101 $ 461 18,300 SH SOLE 1 X

NATIONAL OILWELL

VARCO INC COM 637071101 $ 1,565 35,200 SH SOLE 1 X

NELNET INC CL A 64031N108 $ 357 15,600 SH SOLE 1 X

NET 1 UEPS TECHNOLOGIES INC COM NEW 64107N206 $ 118 10,200 SH SOLE 1 X

NET SERVICOS DE

COMUNICACAO SA SPONSD ADR NEW 64109T201 $ 165 12,700 SH SOLE 1 X

NETFLIX INC COM 64110L106 $ 4,054 25,000 SH SOLE 1 X

NETEZZA CORP COM 64111N101 $ 304 11,300 SH SOLE 1 X

NETGEAR INC COM 64111Q104 $ 375 13,900 SH SOLE 1 X

NEVSUN RES LTD COM 64156L101 $ 3,424 698,873 SH SHARED (OTHER) 1 X

NEW GOLD INC CDA COM 644535106 $ 4,417 656,277 SH SHARED (OTHER) 1 X

NEW ORIENTAL ED &

TECH GRP INC SPON ADR 647581107 $ 10,134 103,850 SH SOLE 1 X

NEWELL RUBBERMAID INC COM 651229106 $ 682 38,300 SH SOLE 1 X

NEWMARKET CORP COM 651587107 $ 489 4,300 SH SOLE 1 X

NEWMONT MINING CORP COM 651639106 $ 427 6,800 SH SOLE 1 X

NEWPORT CORP SB NT CV 2.5%12 651824AB0 $ 11,815 12,041,000 PRN SOLE 1 X

NEXEN INC COM 65334H102 $ 259 12,900 SH SOLE 1 X

NIKE INC CL B 654106103 $ 305 3,800 SH SOLE 1 X

NISOURCE INC COM 65473P105 $ 179 10,300 SH SOLE 1 X

NORFOLK SOUTHERN CORP COM 655844108 $ 434 7,300 SH SOLE 1 X

NORTH AMERN ENERGY

PARTNERS COM 656844107 $ 150 18,400 SH SOLE 1 X

NORTHERN DYNASTY

MINERALS LTD COM NEW 66510M204 $ 4,132 485,528 SH SHARED (OTHER) 1 X

NORTHWEST BANCSHARES

INC MD COM 667340103 $ 149 13,300 SH SOLE 1 X

NOVAGOLD RES INC COM NEW 66987E206 $ 112,791 12,905,142 SH SOLE 1 X

NOVELL INC COM 670006105 $ 839 140,500 SH SOLE 1 X

NU SKIN ENTERPRISES INC CL A 67018T105 $ 360 12,500 SH SOLE 1 X

NV ENERGY INC COM 67073Y106 $ 664 50,500 SH SOLE 1 X

OCCIDENTAL PETE CORP DEL COM 674599105 $ 501 6,400 SH SOLE 1 X

OCEANEERING INTL INC COM 675232102 $ 506 9,400 SH SOLE 1 X

ODYSSEY MARINE

EXPLORATION INC COM 676118102 $ 89 48,200 SH SOLE 1 X

OFFICEMAX INC DEL COM 67622P101 $ 162 12,400 SH SOLE 1 X

OIL STS INTL INC COM 678026105 $ 414 8,900 SH SOLE 1 X

OLIN CORP COM PAR $1 680665205 $ 425 21,100 SH SOLE 1 X

OMNICARE INC COM 681904108 $ 418 17,500 SH SOLE 1 X

OMNIAMERICAN

BANCORP INC COM 68216R107 $ 124 11,000 SH SOLE 1 X

ON SEMICONDUCTOR CORP COM 682189105 $ 397 55,000 SH SOLE 1 X

ONEOK INC NEW COM 682680103 $ 968 21,500 SH SOLE 1 X

ONYX PHARMACEUTICALS

INC COM 683399109 $ 472 17,900 SH SOLE 1 X

OPENWAVE SYS INC COM NEW 683718308 $ 165 97,300 SH SOLE 1 X

ORACLE CORP COM 68389X105 $ 835 31,100 SH SOLE 1 X

ORBITAL SCIENCES CORP SR SUB NT CV 27 685564AN6 $ 65,295 65,623,000 PRN SOLE 1 X

O REILLY AUTOMOTIVE INC COM 686091109 $ 750 14,100 SH SOLE 1 X

OWENS CORNING NEW COM 690742101 $ 343 13,400 SH SOLE 1 X

OWENS ILL INC COM NEW 690768403 $ 247 8,800 SH SOLE 1 X

PHH CORP COM NEW 693320202 $ 1,215 57,700 SH SOLE 1 X

PMC-SIERRA INC COM 69344F106 $ 4,771 648,266 SH SOLE 1 X

PMI GROUP INC COM 69344M101 $ 187 50,900 SH SOLE 1 X

PPL CORP COM 69351T106 $ 1,130 41,500 SH SOLE 1 X

PSS WORLD MED INC COM 69366A100 $ 6,949 325,000 SH SOLE 1 X

PACKAGING CORP AMER COM 695156109 $ 938 40,500 SH SOLE 1 X

PACTIV CORP COM 695257105 $ 871 26,400 SH SOLE 1 X

PARAMETRIC TECHNOLOGY

CORP COM NEW 699173209 $ 256 13,100 SH SOLE 1 X

PEABODY ENERGY CORP COM 704549104 $ 2,451 50,000 SH SOLE 1 X

PENN NATL GAMING INC COM 707569109 $ 518 17,500 SH SOLE 1 X

PENSKE AUTOMOTIVE

GRP INC COM 70959W103 $ 143 10,800 SH SOLE 1 X

PEOPLES UNITED FINANCIAL

INC COM 712704105 $ 390 29,800 SH SOLE 1 X

PEP BOYS MANNY MOE

& JACK COM 713278109 $ 443 41,900 SH SOLE 1 X

PEPCO HOLDINGS INC COM 713291102 $ 251 13,500 SH SOLE 1 X

PEPSICO INC COM 713448108 $ 591 8,900 SH SOLE 1 X

PERFECT WORLD CO LTD SPON ADR REP B 71372U104 $ 7,105 276,900 SH SOLE 1 X

PETSMART INC COM 716768106 $ 221 6,300 SH SOLE 1 X

PFIZER INC COM 717081103 $ 41,433 2,413,100 SH SOLE 1 X

PHARMACEUTICAL PROD

DEV INC COM 717124101 $ 503 20,300 SH SOLE 1 X

PHILIP MORRIS INTL INC COM 718172109 $ 980 17,500 SH SOLE 1 X

PHILLIPS VAN HEUSEN CORP COM 718592108 $ 1,480 24,600 SH SOLE 1 X

PILGRIMS PRIDE CORP NEW COM 72147K108 $ 150 26,700 SH SOLE 1 X

PINNACLE AIRL CORP COM 723443107 $ 162 29,800 SH SOLE 1 X

PLAINS EXPL& PRODTN CO COM 726505100 $ 180,858 6,781,315 SH SOLE 1 X

PLATINUM GROUP

METALS LTD COM NEW 72765Q205 $ 3,515 1,500,000 SH SOLE 1 X

POLARIS INDS INC COM 731068102 $ 202 3,100 SH SOLE 1 X

POLO RALPH LAUREN CORP CL A 731572103 $ 315 3,500 SH SOLE 1 X

POLYONE CORP COM 73179P106 $ 578 47,800 SH SOLE 1 X

POPULAR INC COM 733174106 $ 30,311 10,452,200 SH SOLE 1 X

POPULAR INC COM 733174106 $ 496 171,000 SH SHARED (OTHER) 1 X

POTASH CORP SASK INC COM 73755L107 $ 16,565 115,000 SH SOLE 1 X

POWER ONE INC NEW COM 73930R102 $ 4,646 511,100 SH SOLE 1 X

PRE PAID LEGAL SVCS INC COM 740065107 $ 687 11,000 SH SOLE 1 X

PRECISION CASTPARTS

CORP COM 740189105 $ 1,324 10,400 SH SOLE 1 X

PRESTIGE BRANDS HLDGS

INC COM 74112D101 $ 106 10,700 SH SOLE 1 X

PRICELINE COM INC COM NEW 741503403 $ 616 1,767 SH SOLE 1 X

PRICESMART INC COM 741511109 $ 583 20,000 SH SOLE 1 X

PRINCETON REVIEW INC COM 742352107 $ 45 22,100 SH SOLE 1 X

PROGRESS ENERGY INC COM 743263105 $ 227 5,100 SH SOLE 1 X

PUBLIC SVC ENTERPRISE

GROUP COM 744573106 $ 347 10,500 SH SOLE 1 X

PULTE GROUP INC COM 745867101 $ 257 29,300 SH SOLE 1 X

QLIK TECHNOLOGIES INC COM 74733T105 $ 6,615 300,000 SH SOLE 1 X

QEP RES INC COM 74733V100 $ 793 26,300 SH SOLE 1 X

QUALCOMM INC COM 747525103 $ 32,591 722,311 SH SOLE 1 X

QUEST SOFTWARE INC COM 74834T103 $ 455 18,500 SH SOLE 1 X

QUESTAR CORP COM 748356102 $ 305 17,400 SH SOLE 1 X

QUICKSILVER RESOURCES

INC COM 74837R104 $ 195 15,500 SH SOLE 1 X

QWEST COMMUNICATIONS

INTL INC COM 749121109 $ 693 110,500 SH SOLE 1 X

RF MICRODEVICES INC COM 749941100 $ 261 42,500 SH SOLE 1 X

RF MICRODEVICES INC SUB NT CV0.75%12 749941AG5 $ 83,525 81,887,000 PRN SOLE 1 X

RF MICRODEVICES INC SUB NT CV 1%14 749941AJ9 $ 117,246 116,663,000 PRN SOLE 1 X

RADIOSHACK CORP COM 750438103 $ 220 10,300 SH SOLE 1 X

RAILAMERICA INC COM 750753402 $ 6,741 700,000 SH SOLE 1 X

RALCORP HLDGS INC NEW COM 751028101 $ 544 9,300 SH SOLE 1 X

RANGE RES CORP COM 75281A109 $ 3,382 88,700 SH SOLE 1 X

RAYTHEON CO WT EXP 061611 755111119 $ 2 259 SH SOLE 1 X

RAYTHEON CO COM NEW 755111507 $ 608 13,300 SH SOLE 1 X

REGAL BELOIT CORP COM 758750103 $ 7,806 133,000 SH SOLE 1 X

REGAL ENTMT GROUP CL A 758766109 $ 131 10,000 SH SOLE 1 X

REGIONS FINANCIAL

CORP NEW COM 7591EP100 $ 391 53,800 SH SOLE 1 X

RELIANCE STEEL &

ALUMINUM CO COM 759509102 $ 407 9,800 SH SOLE 1 X

RENESOLA LTD SPONS ADS 75971T103 $ 149 11,900 SH SOLE 1 X

RENTRAK CORP COM 760174102 $ 4,171 165,069 SH SOLE 1 X

REPUBLIC SVCS INC COM 760759100 $ 335 11,000 SH SOLE 1 X

RESEARCH IN MOTION LTD COM 760975102 $ 945 19,400 SH SOLE 1 X

RETAIL OPPORTUNITY

INVTS CORP COM 76131N101 $ 145 15,100 SH SOLE 1 X

ROCK-TENN CO CL A 772739207 $ 468 9,400 SH SOLE 1 X

ROGERS COMMUNICATIONS

INC CL B 775109200 $ 951 25,400 SH SOLE 1 X

ROSS STORES INC COM 778296103 $ 355 6,500 SH SOLE 1 X

RUTHS HOSPITALITY

GROUP INC COM 783332109 $ 120 29,900 SH SOLE 1 X

RYDER SYS INC COM 783549108 $ 274 6,400 SH SOLE 1 X

SLM CORP COM 78442P106 $ 328 28,400 SH SOLE 1 X

SPDR S&P 500 ETF TR TR UNIT 78462F103 $ 17,131 150,100 SH CALL SOLE 1 X

SPDR S&P 500 ETF TR TR UNIT 78462F103 $ 77,038 675,000 SH PUT SOLE 1 X

SPX CORP COM 784635104 $ 367 5,800 SH SOLE 1 X

SPDR GOLD TRUST GOLD SHS 78463V107 $ 600,794 4,697,008 SH SOLE 1 X

SPDR GOLD TRUST GOLD SHS 78463V107 $ 90,177 705,000 SH CALL SOLE 1 X

STEC INC COM 784774101 $ 238 19,100 SH SOLE 1 X

SALIX PHARMACEUTICALS

INC COM 795435106 $ 10,923 275,000 SH SOLE 1 X

SANDISK CORP COM 80004C101 $ 517 14,100 SH SOLE 1 X

SANDISK CORP SR NT CV 1%13 80004CAC5 $ 23,063 25,000,000 PRN SOLE 1 X

SANMINA SCI CORP COM NEW 800907206 $ 576 47,700 SH SOLE 1 X

SAPIENT CORP COM 803062108 $ 1,572 131,300 SH SOLE 1 X

SARA LEE CORP COM 803111103 $ 1,022 76,100 SH SOLE 1 X

SCOTTS MIRACLE GRO CO CL A 810186106 $ 217 4,200 SH SOLE 1 X

SCRIPPS NETWORKS

INTERACT INC CL A COM 811065101 $ 376 7,900 SH SOLE 1 X

SEABRIGHT HOLDINGS INC COM 811656107 $ 175 21,700 SH SOLE 1 X

SEABRIDGE GOLD INC COM 811916105 $ 9,744 339,764 SH SHARED (OTHER) 1 X

SELECT SECTOR SPDR TR SBI HEALTHCARE 81369Y209 $ 17,009 558,053 SH SOLE 1 X

SEMICONDUCTOR

HLDRS TR DEP RCPT 816636203 $ 2,771 100,000 SH PUT SOLE 1 X

SEMPRA ENERGY COM 816851109 $ 936 17,400 SH SOLE 1 X

SERVICE CORP INTL COM 817565104 $ 126 14,600 SH SOLE 1 X

SHAW GROUP INC COM 820280105 $ 1,235 36,800 SH SOLE 1 X

SHERWIN WILLIAMS CO COM 824348106 $ 526 7,000 SH SOLE 1 X

SIRIUS SATELLITE RADIO

INC NT CV 3.25%11 82966UAD5 $ 29,158 29,268,000 PRN SOLE 1 X

SKECHERS U S A INC CL A 830566105 $ 402 17,100 SH SOLE 1 X

SNAP ON INC COM 833034101 $ 749 16,100 SH SOLE 1 X

SOLUTIA INC COM NEW 834376501 $ 15,190 948,209 SH SOLE 1 X

SONIC CORP COM 835451105 $ 107 13,300 SH SOLE 1 X

SONUS NETWORKS INC COM 835916107 $ 54 15,300 SH SOLE 1 X

SOUFUN HLDGS LTD ADR 836034108 $ 2,170 33,300 SH SOLE 1 X

SOUTHERN UN CO NEW COM 844030106 $ 1,078 44,800 SH SOLE 1 X

SPRINT NEXTEL CORP COM SER 1 852061100 $ 3,292 710,912 SH SOLE 1 X

STANLEY BLACK &

DECKER INC COM 854502101 $ 447 7,300 SH SOLE 1 X

STAPLES INC COM 855030102 $ 634 30,300 SH SOLE 1 X

STARBUCKS CORP COM 855244109 $ 376 14,700 SH SOLE 1 X

STARWOOD PPTY TR INC COM 85571B105 $ 336 16,900 SH SOLE 1 X

STATE STR CORP COM 857477103 $ 456 12,100 SH SOLE 1 X

STERIS CORP COM 859152100 $ 226 6,800 SH SOLE 1 X

STONE ENERGY CORP COM 861642106 $ 1,641 111,400 SH SOLE 1 X

STRYKER CORP COM 863667101 $ 380 7,600 SH SOLE 1 X

SUN LIFE FINL INC COM 866796105 $ 266 10,200 SH SOLE 1 X

SUNCOR ENERGY INC NEW COM 867224107 $ 1,729 53,100 SH SOLE 1 X

SUNOCO INC COM 86764P109 $ 391 10,700 SH SOLE 1 X

SUPERVALU INC COM 868536103 $ 150 13,000 SH SOLE 1 X

SUSQUEHANNA BANCSHARES

INC PA COM 869099101 $ 104 12,300 SH SOLE 1 X

SYCAMORE NETWORKS INC COM NEW 871206405 $ 3,461 106,800 SH SOLE 1 X

SYMANTEC CORP COM 871503108 $ 300 19,800 SH SOLE 1 X

SYNOVUS FINL CORP COM 87161C105 $ 206 83,600 SH SOLE 1 X

TD AMERITRADE HLDG CORP COM 87236Y108 $ 491 30,400 SH SOLE 1 X

TECO ENERGY INC COM 872375100 $ 262 15,100 SH SOLE 1 X

TJX COS INC NEW COM 872540109 $ 263 5,900 SH SOLE 1 X

TNS INC COM 872960109 $ 175 10,300 SH SOLE 1 X

TALBOTS INC COM 874161102 $ 392 29,952 SH SOLE 1 X

TARGET CORP COM 87612E106 $ 1,988 37,200 SH SOLE 1 X

TECH DATA CORP SR DB CV 2.75%26 878237AE6 $ 33,283 32,590,000 PRN SOLE 1 X

TECK RESOURCES LTD CL B 878742204 $ 774 18,800 SH SOLE 1 X

TEKELEC COM 879101103 $ 587 45,300 SH SOLE 1 X

TELLABS INC COM 879664100 $ 462 62,000 SH SOLE 1 X

TENET HEALTHCARE CORP COM 88033G100 $ 106 22,400 SH SOLE 1 X

TENNECO INC COM 880349105 $ 214 7,400 SH SOLE 1 X

TERADATA CORP DEL COM 88076W103 $ 22,816 591,700 SH SOLE 1 X

TERADATA CORP DEL COM 88076W103 $ 8,607 223,200 SH CALL SOLE 1 X

TERADYNE INC COM 880770102 $ 135 12,100 SH SOLE 1 X

TEREX CORP NEW COM 880779103 $ 6,876 300,000 SH SOLE 1 X

TESORO CORP COM 881609101 $ 164 12,300 SH SOLE 1 X

TEVA PHARMACEUTICAL

INDS LTD ADR 881624209 $ 128,942 2,444,400 SH SOLE 1 X

TETRA TECHNOLOGIES

INC DEL COM 88162F105 $ 181 17,700 SH SOLE 1 X

TESSERA TECHNOLOGIES

INC COM 88164L100 $ 313 16,900 SH SOLE 1 X

TEXAS INSTRS INC COM 882508104 $ 2,014 74,200 SH SOLE 1 X

TEXAS ROADHOUSE INC COM 882681109 $ 357 25,400 SH SOLE 1 X

THERMO FISHER SCIENTIFIC

INC COM 883556102 $ 16,088 336,000 SH SOLE 1 X

THOMAS & BETTS CORP COM 884315102 $ 402 9,800 SH SOLE 1 X

THOMSON REUTERS CORP COM 884903105 $ 293 7,800 SH SOLE 1 X

THORATEC CORP COM NEW 885175307 $ 3,698 100,000 SH SOLE 1 X

TIDEWATER INC COM 886423102 $ 2,258 50,400 SH SOLE 1 X

TIM HORTONS INC COM 88706M103 $ 251 6,900 SH SOLE 1 X

TIME WARNER INC COM NEW 887317303 $ 677 22,100 SH SOLE 1 X

TIME WARNER CABLE

INC COM 88732J207 $ 12,660 234,491 SH SOLE 1 X

TOREADOR RES CORP COM 891050106 $ 1,677 150,000 SH SOLE 1 X

TORONTO DOMINION

BK ONT COM NEW 891160509 $ 1,042 14,400 SH SOLE 1 X

TOWERS WATSON & CO CL A 891894107 $ 339 6,900 SH SOLE 1 X

TRACTOR SUPPLY CO COM 892356106 $ 242 6,100 SH SOLE 1 X

TRANSALTA CORP COM 89346D107 $ 355 16,600 SH SOLE 1 X

TRANSCANADA CORP COM 89353D107 $ 768 20,700 SH SOLE 1 X

TRANSDIGM GROUP INC COM 893641100 $ 1,706 27,500 SH SOLE 1 X

TRAVELERS COMPANIES INC COM 89417E109 $ 3,793 72,800 SH SOLE 1 X

TRINITY INDS INC COM 896522109 $ 252 11,300 SH SOLE 1 X

TRIPLE-S MGMT CORP CL B 896749108 $ 229 13,600 SH SOLE 1 X

TURKCELL ILETISIM

HIZMETLERI SPON ADR NEW 900111204 $ 1,198 71,500 SH SOLE 1 X

UAL CORP COM NEW 902549807 $ 263 11,100 SH SOLE 1 X

U S AIRWAYS GROUP INC COM 90341W108 $ 327 35,300 SH SOLE 1 X

ULTICOM INC COM NEW 903844207 $ 1,110 136,667 SH SOLE 1 X

UMPQUA HLDGS CORP COM 904214103 $ 302 26,600 SH SOLE 1 X

UNISOURCE ENERGY CORP COM 909205106 $ 568 17,000 SH SOLE 1 X

UNITED PARCEL SERVICE

INC CL B 911312106 $ 393 5,900 SH SOLE 1 X

UNITED STATIONERS INC COM 913004107 $ 273 5,100 SH SOLE 1 X

UNITED TECHNOLOGIES

CORP COM 913017109 $ 499 7,000 SH SOLE 1 X

UNITED THERAPEUTICS

CORP DEL COM 91307C102 $ 10,491 187,300 SH SOLE 1 X

UNITEDHEALTH GROUP INC COM 91324P102 $ 9,262 263,800 SH SOLE 1 X

UNIVERSAL AMERICAN CORP COM 913377107 $ 392 26,600 SH SOLE 1 X

UNIVERSAL HLTH SVCS INC CL B 913903100 $ 295 7,600 SH SOLE 1 X

VALASSIS COMMUNICATIONS

INC COM 918866104 $ 268 7,900 SH SOLE 1 X

VALE S A ADR 91912E105 $ 2,345 75,000 SH SOLE 1 X

VALERO ENERGY CORP NEW COM 91913Y100 $ 830 47,400 SH SOLE 1 X

VALUECLICK INC COM 92046N102 $ 368 28,100 SH SOLE 1 X

VEECO INSTRS INC DEL COM 922417100 $ 1,032 29,600 SH SOLE 1 X

VERIFONE SYS INC SR NT CV1.375%12 92342YAB5 $ 9,988 10,000,000 PRN SOLE 1 X

VERISIGN INC COM 92343E102 $ 1,349 42,500 SH SOLE 1 X

VERIZON COMMUNICATIONS

INC COM 92343V104 $ 63,829 1,958,546 SH SOLE 1 X

VERINT SYS INC COM 92343X100 $ 4,698 159,000 SH SOLE 1 X

VERIGY LTD SR NT CV 5.25%14 92345XAB4 $ 27,771 26,864,000 PRN SOLE 1 X

VERISK ANALYTICS INC CL A 92345Y106 $ 260 9,300 SH SOLE 1 X

VIACOM INC NEW CL B 92553P201 $ 1,303 36,000 SH SOLE 1 X

VIRGIN MEDIA INC COM 92769L101 $ 207 9,000 SH SOLE 1 X

VISA INC COM CL A 92826C839 $ 5,636 75,900 SH SOLE 1 X

VISA INC COM CL A 92826C839 $ 705 9,500 SH SHARED (OTHER) 1 X

VISHAY INTERTECHNOLOGY

INC COM 928298108 $ 273 28,200 SH SOLE 1 X

VODAFONE GROUP PLC NEW SPONS ADR NEW 92857W209 $ 4,704 189,600 SH SOLE 1 X

WABCO HLDGS INC COM 92927K102 $ 6,098 145,400 SH SOLE 1 X

WAL MART STORES INC COM 931142103 $ 749 14,000 SH SOLE 1 X

WALGREEN CO COM 931422109 $ 472 14,100 SH SOLE 1 X

WALTER ENERGY INC COM 93317Q105 $ 7,639 93,970 SH SOLE 1 X

WALTER ENERGY INC COM 93317Q105 $ 13,535 166,500 SH CALL SOLE 1 X

WARNACO GROUP INC COM NEW 934390402 $ 266 5,200 SH SOLE 1 X

WASTE CONNECTIONS

INC COM 941053100 $ 301 7,600 SH SOLE 1 X

WASTE MGMT INC DEL COM 94106L109 $ 332 9,300 SH SOLE 1 X

WEB COM GROUP INC COM 94733A104 $ 97 17,700 SH SOLE 1 X

WEBMD HEALTH CORP COM 94770V102 $ 827 16,590 SH SOLE 1 X

WELLPOINT INC COM 94973V107 $ 6,185 109,200 SH SOLE 1 X

WELLS FARGO & CO NEW COM 949746101 $ 1,126 44,800 SH SOLE 1 X

WENDYS ARBYS GROUP

INC COM 950587105 $ 196 43,300 SH SOLE 1 X

WERNER ENTERPRISES INC COM 950755108 $ 432 21,100 SH SOLE 1 X

WESCO INTL INC COM 95082P105 $ 240 6,100 SH SOLE 1 X

WESTERN DIGITAL CORP COM 958102105 $ 210 7,400 SH SOLE 1 X

WESTERN UN CO COM 959802109 $ 663 37,500 SH SOLE 1 X

WESTPORT INNOVATIONS

INC COM NEW 960908309 $ 57,322 3,256,910 SH SOLE 1 X

WILLIAMS COS INC DEL COM 969457100 $ 650 34,000 SH SOLE 1 X

WISCONSIN ENERGY CORP COM 976657106 $ 249 4,300 SH SOLE 1 X

WYNDHAM WORLDWIDE

CORP COM 98310W108 $ 1,269 46,200 SH SOLE 1 X

XILINX INC COM 983919101 $ 365 13,700 SH SOLE 1 X

XEROX CORP COM 984121103 $ 4,031 389,500 SH SOLE 1 X

YAHOO INC COM 984332106 $ 48,267 3,406,300 SH SOLE 1 X

YUM BRANDS INC COM 988498101 $ 889 19,300 SH SOLE 1 X

ZIMMER HLDGS INC COM 98956P102 $ 450 8,600 SH SOLE 1 X

ALLIED WRLD ASSUR COM

HLDG LTD SHS G0219G203 $ 413 7,300 SH SOLE 1 X

AMDOCS LTD ORD G02602103 $ 656 22,900 SH SOLE 1 X

AXIS CAPITAL HOLDINGS SHS G0692U109 $ 1,706 51,800 SH SOLE 1 X

ACCENTURE PLC IRELAND SHS CLASS A G1151C101 $ 4,636 109,100 SH SOLE 1 X

COVIDIEN PLC SHS G2554F105 $ 406 10,100 SH SOLE 1 X

EVEREST RE GROUP LTD COM G3223R108 $ 4,133 47,800 SH SOLE 1 X

GENPACT LIMITED SHS G3922B107 $ 356 20,100 SH SOLE 1 X

HERBALIFE LTD COM USD SHS G4412G101 $ 610 10,100 SH SOLE 1 X

INGERSOLL-RAND PLC SHS G47791101 $ 457 12,800 SH SOLE 1 X

INVESCO LTD SHS G491BT108 $ 626 29,500 SH SOLE 1 X

LAZARD LTD SHS A G54050102 $ 15,961 455,000 SH SOLE 1 X

LAZARD LTD SHS A G54050102 $ 26,573 757,500 SH CALL SOLE 1 X

MAIDEN HOLDINGS LTD SHS G5753U112 $ 103 13,500 SH SOLE 1 X

MARVELL TECHNOLOGY

GROUP LTD ORD G5876H105 $ 208 11,900 SH SOLE 1 X

NABORS INDUSTRIES LTD SHS G6359F103 $ 329 18,200 SH SOLE 1 X

PARTNERRE LTD COM G6852T105 $ 4,554 56,800 SH SOLE 1 X

SIGNET JEWELERS LIMITED SHS G81276100 $ 816 25,700 SH SOLE 1 X

SINA CORP ORD G81477104 $ 2,529 50,000 SH SOLE 1 X

TRANSATLANTIC PETROLEUM

LTD SHS G89982105 $ 1,769 600,000 SH SOLE 1 X

WHITE MTNS INS GROUP LTD COM G9618E107 $ 1,717 5,567 SH SHARED (OTHER) 1 X

WILLIS GROUP HOLDINGS

PUBLIC L SHS G96666105 $ 567 18,400 SH SOLE 1 X

XL GROUP PLC SHS G98290102 $ 334 15,400 SH SOLE 1 X

ACE LTD SHS H0023R105 $ 408 7,000 SH SOLE 1 X

ALCON INC COM SHS H01301102 $ 2,302 13,800 SH SOLE 1 X

WEATHERFORD

INTERNATIONAL LTD REG H27013103 $ 122,701 7,175,522 SH SOLE 1 X

TRANSOCEAN LTD REG SHS H8817H100 $ 463 7,200 SH SOLE 1 X

TYCO INTERNATIONAL

LTD SHS H89128104 $ 984 26,800 SH SOLE 1 X

MILLICOM INTL CELLULAR

S A SHS NEW L6388F110 $ 307 3,200 SH SOLE 1 X

CHECK POINT SOFTWARE

TECH LTD ORD M22465104 $ 558 15,100 SH SOLE 1 X

CLICKSOFTWARE

TECHNOLOGIES LTD ORD M25082104 $ 1,999 306,666 SH SOLE 1 X

CNH GLOBAL N V SHS NEW N20935206 $ 249 6,800 SH SOLE 1 X

SENSATA TECHNOLOGIES

HLDG BV A SHS N7902X106 $ 221 11,200 SH SOLE 1 X

VISTAPRINT N V SHS N93540107 $ 216 5,600 SH SOLE 1 X

MAKEMYTRIP LIMITED

MAURITIUS SHS V5633W109 $ 1,167 30,100 SH SOLE 1 X

ROYAL CARIBBEAN

CRUISES LTD COM V7780T103 $ 249 7,900 SH SOLE 1 X

FLEXTRONICS INTL LTD ORD Y2573F102 $ 481 79,700 SH SOLE 1 X

GENERAL MARITIME

CORP NEW SHS Y2693R101 $ 3,683 750,000 SH SOLE 1 X

VERIGY LTD SHS Y93691106 $ 50 6,100 SH SOLE 1 X

gesamt: U$ 6,692,348

The following investment managers that are required to file a report pursuant to

Section 13 (f) of the Securities and Exchange Act of 1934 („Section 13 (f)“)

exercise investment discretion with respect to certain securities held in

accounts for which Soros Fund Management LLC („SFM LLC“) acts as principal

investment manager, and certain limited partnerships in which such accounts are

directly or indirectly partners, and such managers will report such positions on

their reports:

028-06437 Atlantic Investment Management, Inc.

028-12212 Discovery Capital Management, LLC

028-11106 EAC Management LP

028-10354 FrontPoint Partners LLC

028-06256 Martin Currie Investment Management Ltd.

028-13693 Realm Partners LLC

028-13383 Round Table Investment Management Company, LP

028-10804 RR Partners LP

028-05395 Select Equity Group, Inc.

028-05369 Sirios Capital Management, L.P.

** Certain securities reported herein are managed by investment managers that

are not required to file a report pursuant to Section 13(f).The inclusion of

such securities herein shall not be deemed an admission that George Soros or SFM

LLC has investment discretion or voting authority over such securities.

$6,692,348

Genug ist nie genug – speziell bei Juden – die ewig unschuldig Verfolgten !!

Antisemitismus Akt USA – Global Anti-Semitism Review Act

https://www.wipi.at/antisemitismus-usa

George Soros und die open society foundations – die EU und ihre Hintermänner

Flüchtlingsproblem in Europa – die EU und ihre Hintermänner beim Flüchtlingsgeschäft

George Soros Drogenpolitik in Österreich und international!

Die WHO empfiehlt CBD – Cannabidiol nicht für medizinische Zwecke

Sollte Ihnen der Beitrag gefallen, erzählen Sie es weiter!

Speziell dieser Beitrag kostete viele Tage und Stunden die Fakten zu recherchieren!

Als freischaffender Journalist bekomme ich keinerlei Bezahlung oder finanzielle Unterstützung !

Ich freue mich auch über ein paar Euros nur!

Spendenkonto: Winfried ZEHM,

Zehm Winfried Michael

AT38 1600 0001 1703 2299

Verwendungszweck: Schenkung wipinews

Sorry, the comment form is closed at this time.